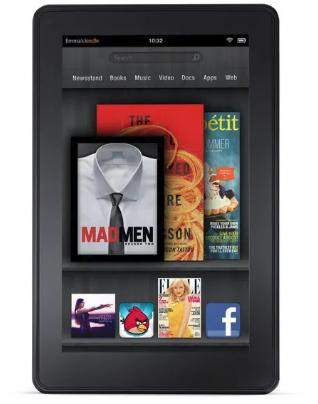

Kindle Fire HD: Amazon's Tablet Strategy

Amazon’s $299 tablet undercut iPad by $200 and owned content delivery, shipping 3M+ units in year one despite iOS app dominance.

The Strategy

iPad was for content creation. Fire HD was for content consumption. We didn’t try to beat Apple at raw performance; we built a tablet for Prime members. Want to stream a movie, read a book, buy physical goods, and have it all sync? That’s Fire HD.

Fire OS (Amazon’s Android fork) cut away Google Play entirely. Every app, every service, every prompt funneled back into Amazon’s ecosystem: Prime Video, Kindle books, Amazon Music, Audible. This wasn’t fragmentation—it was focus.

Specs that mattered:

- 8.9-inch LCD, 1920×1200 (16:10 for video, not square like iPad)

- Dual-core TI OMAP (not a speed demon, but enough for streaming)

- 1GB RAM + 16/32GB storage (for movies and books, not gaming)

- Stereo speakers on both sides (landscape viewing was the default)

- $299 starting price ($200 cheaper than iPad 3)

The Traction

- Year 1: 3M+ units shipped (vs. iPad’s 10M+ but at half the price point)

- Prime members: 60%+ adoption within 18 months

- Ecosystem lock-in: Whispersync for Video meant a user who started a movie on their TV could resume on the tablet—without thinking about another platform

- Content moat: 2M+ Kindle books, thousands of Prime Video titles, Amazon Music library—all one tap away

The math was simple: at $299, we lost money on hardware. We made it back on Prime subscriptions, digital content sales, and physical goods purchased through the tablet’s shopping app.

What Failed (But Taught Us)

- Gaming: Devs prioritized iOS. Fire HD’s GPU couldn’t compete with iPad A5X anyway

- The app gap: Fire Appstore had 50K apps vs. App Store’s 500K. Users felt it

- Thermal issues: Streaming video + narrow bezels = hot laps in summer. We learned this the hard way in Year 2

What worked:

- Content-first design (16:10 aspect ratio, stereo speakers, landscape orientation)

- Amazon account sync (every action logged, every preference saved)

- Price positioning (owned the $250–350 segment entirely)

The Lesson

You can’t beat Apple at their game. We won by defining a different game: not the most powerful tablet, but the most useful tablet for consuming Amazon’s content. For every user who wanted to edit photos or code on a tablet, there were 10 who just wanted to watch movies and read books without ads.

Fire HD proved that vertical integration + differentiated positioning > raw specs.